Search website

Translate Site

Subject Leader: Mrs Wreford

Intent

On average children begin to receive pocket money aged seven, own their first mobile phone at eight, and purchase items online at ten, with one in five having used their parents’ or older siblings’ credit or debit card to purchase these items.

They can open a bank account and have a debit card at 11. At 18 they can apply for a credit card or loan, and before they leave school, they have to make crucial decisions about jobs, student loans, and living independently.

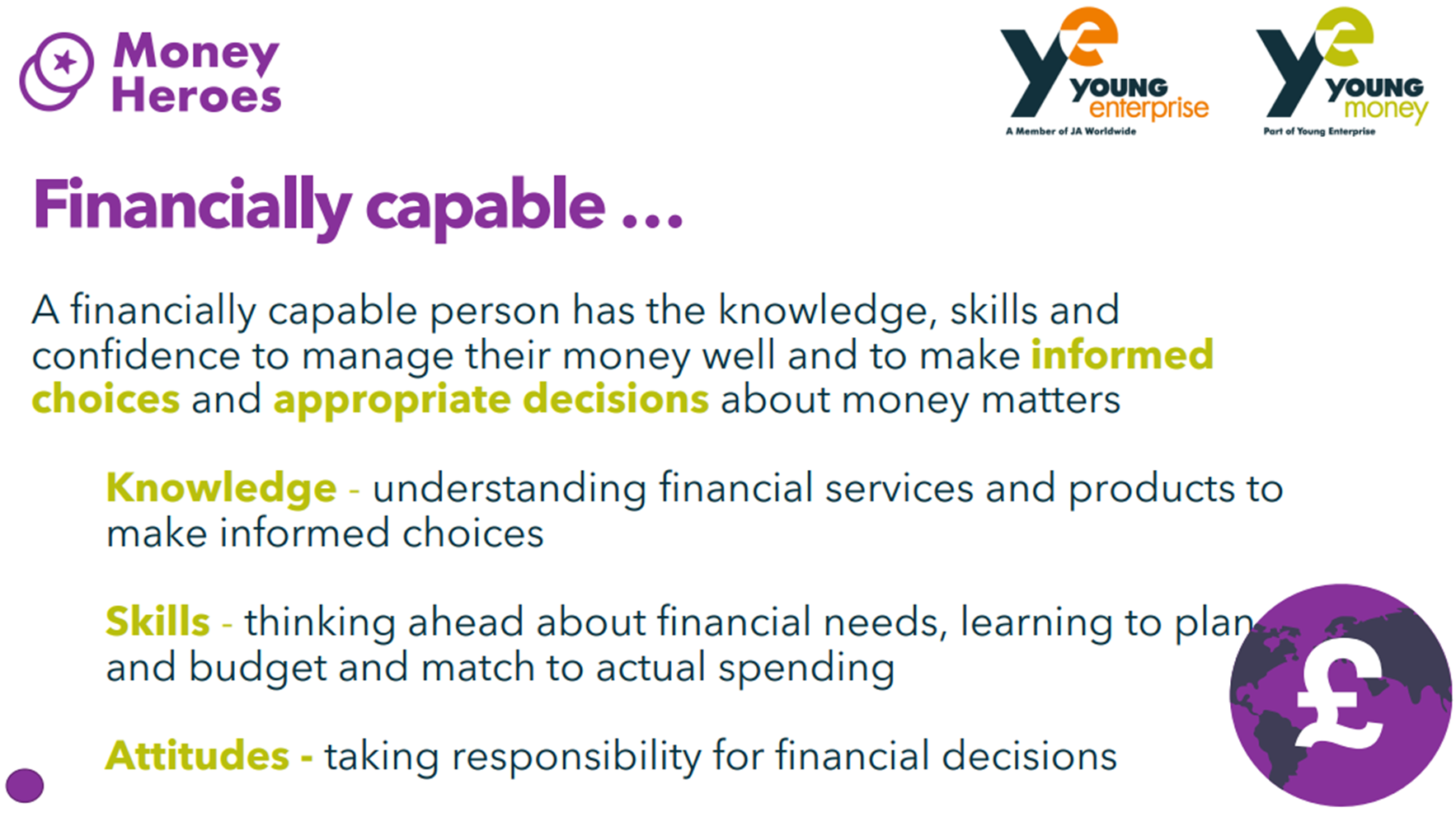

Although not part of the National Curriculum, we believe the need for young people to develop the skills to earn and look after their money has never been stronger.

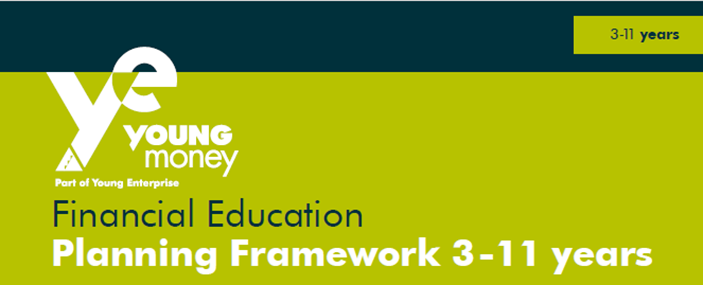

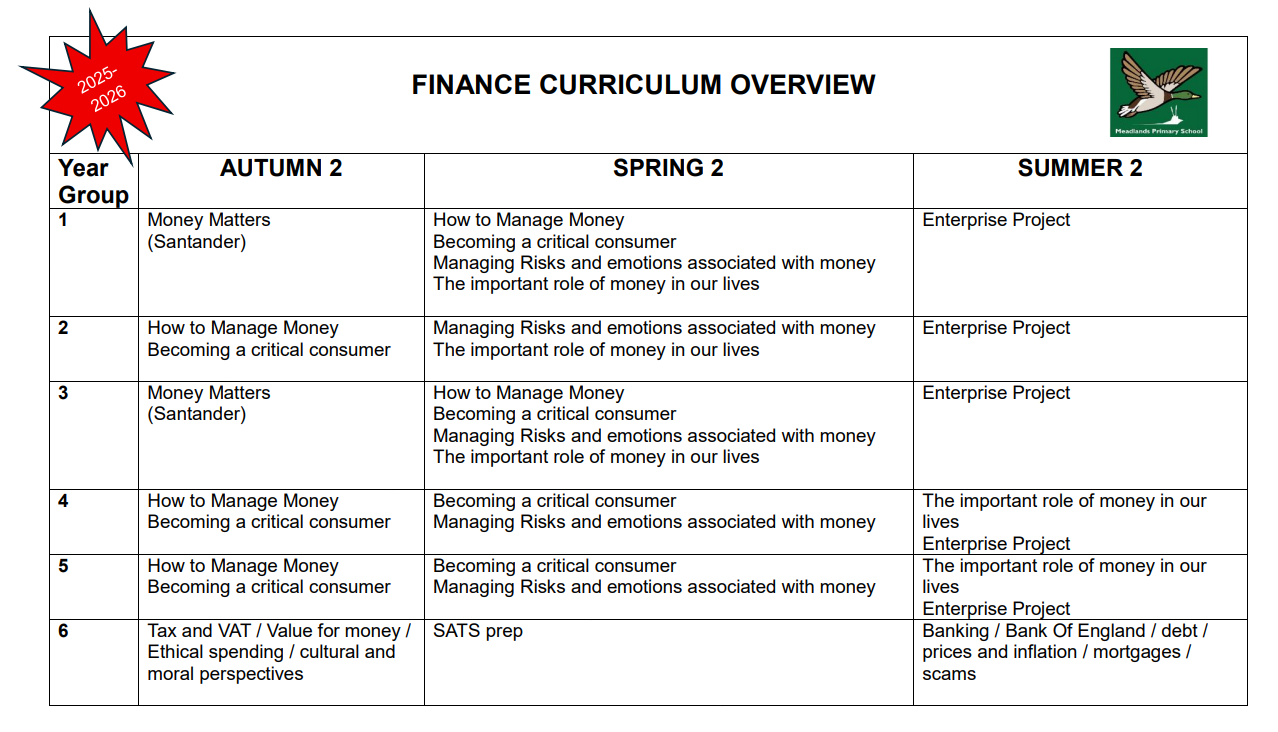

Lessons are taught in Autumn 2, Spring 2 and Summer 2. We follow the Young Enterprise scheme, tailored especially for children.

There are four key areas of learning:

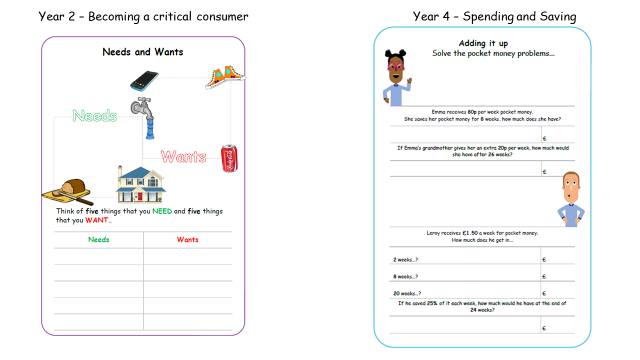

Examples of activities

Examples of activities

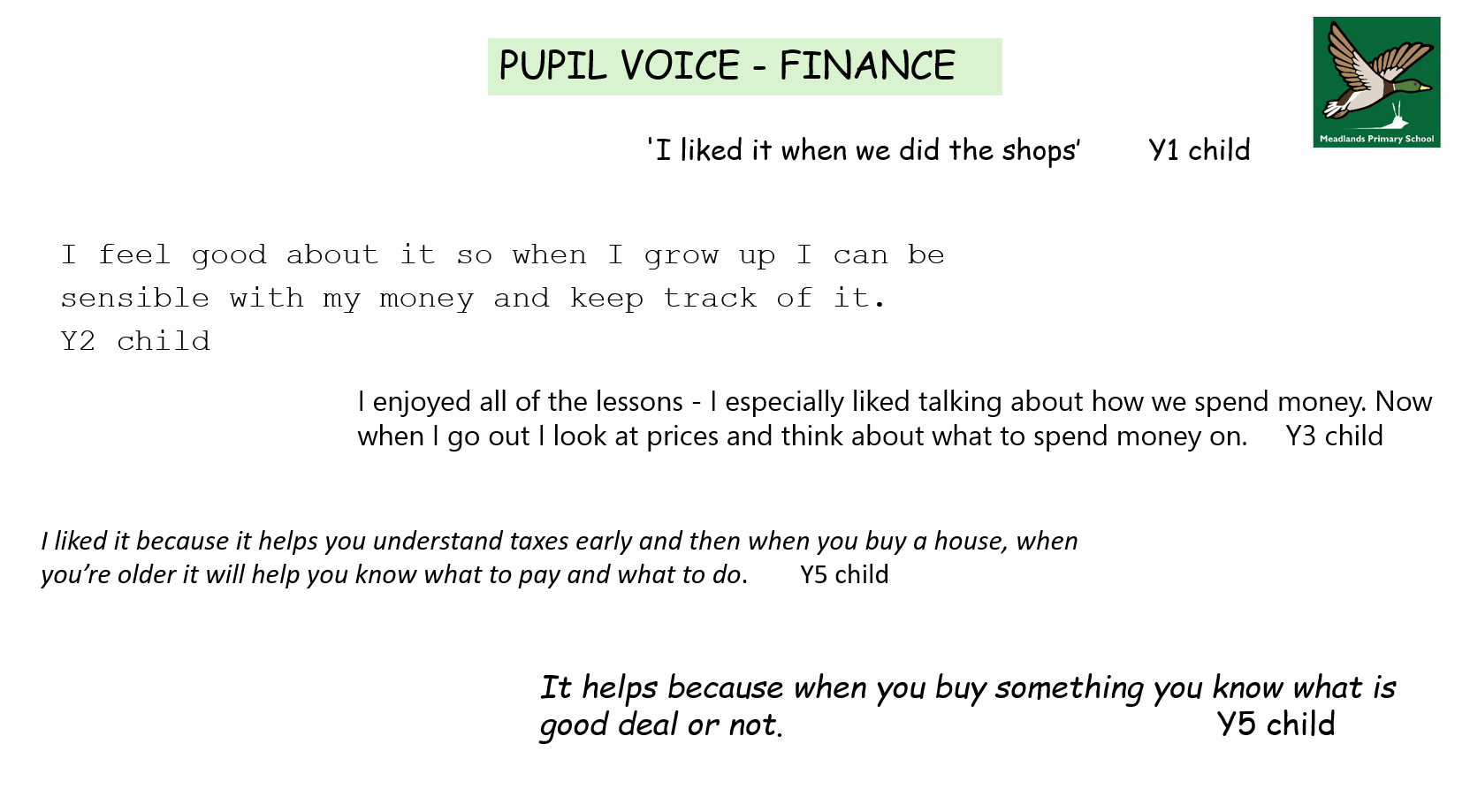

We want our young people to develop a positive relationship with money and financial capability.

Meadlands Primary School

Broughton Avenue, Ham, Richmond, Surrey, TW10 7TS